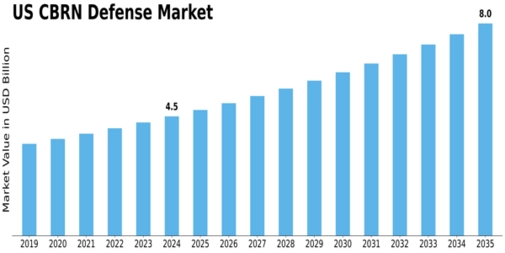

The security challenges confronting the United States in the 2020s have intensified — prompting significant investment in defense technologies aimed at chemical, biological, radiological, and nuclear threat mitigation. The most recent report by MRFR indicates the US CBRN Defense Market was pegged at USD 3.88 billion in 2023 and is expected to grow to USD 8.0 billion by 2035 at a CAGR of roughly 5.37%. Such growth reflects a growing recognition across government, security agencies, and civil defense communities that threats are evolving — from traditional warfare to asymmetric attacks, terrorism, and industrial accidents. Against this backdrop, demand for advanced protective gear, decontamination systems, detection instruments, and integrated response platforms continues to climb.

A major factor fueling this trend is increased government spending under defence modernization impulses. Key defense contractors like Raytheon Technologies, General Dynamics, BAE Systems, Sierra Nevada Corporation, and others are actively supplying CBRN solutions tailored to U.S. requirements. The widening product portfolio — from chemical agent detectors to protective suits and decontamination kits — reflects a strategic shift toward comprehensive preparedness. As conventional warfare evolves and non-state threats grow more unpredictable, these capabilities become vital.

Within the US CBRN Defense Market, the chemical segment continues to dominate in terms of revenue share, driven by persistent concerns over chemical agent deployment, industrial chemical hazards, and potential terrorist use of chemical weapons. However, the biological segment is not far behind, gaining prominence as global health crises and biosecurity awareness rise. Additionally, radiological and nuclear threat preparedness remains a strategic priority, particularly given the potential for high-impact incidents. This multi-threat coverage underscores the complicated security landscape facing modern defense planners.

Another noteworthy trend is the expanding role of detection and monitoring systems. As highlighted in broader market studies, detection & monitoring often account for more than half of demand in CBRN/CBRNE markets, with protective wearables, decontamination systems, and training/simulation solutions also seeing rising adoption. For the U.S., this means investment not only in hardware, but also in human-capital training, rapid-response capabilities, and simulation-based preparedness. The end result is a more resilient and responsive CBRN defense ecosystem — blending technology, strategy, and operational readiness.

Projecting forward to 2035, the US CBRN defense market’s growth to around USD 8.0 billion signals robust demand over the next decade. As geopolitical tensions intensify and threats become more diversified, the United States is likely to continue strengthening its defense posture through investments in detection, protection, decontamination, and training. For defense contractors, technology firms, government agencies, and civil-defense stakeholders, the expanding CBRN sector presents both a challenge and an opportunity — one that could define national security resilience for years to come.

Related Report:

US Aircraft Ejection Seat market

US Aircraft Engine Nacelle market