The demand for drone defense systems in Europe is being driven by a mix of end users — from military and defense agencies to homeland security and even certain commercial sectors.

Military & Defense continues to be the dominant end‑user segment. Amid rising geopolitical tensions, modernization efforts, and evolving aerial threat environments, European militaries are prioritizing drone detection and countermeasure capabilities. The need for secure airspace, especially in conflict-prone zones or near border regions, is fueling substantial procurement.

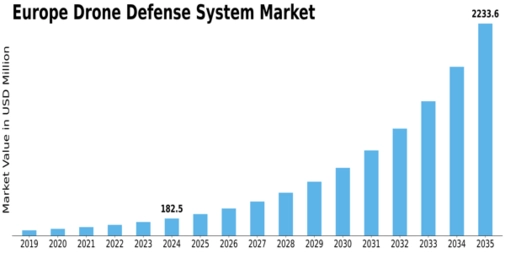

Europe drone defense market At the same time, Homeland Security agencies are ramping up efforts to safeguard critical infrastructure, airports, government facilities, and public events. With drones being misused for illicit surveillance or breaches, counter‑drone systems are becoming indispensable for security at airports, energy installations, and large gatherings.

While Commercial applications are currently smaller in share compared to defense and security, there is increasing interest in using drone defense systems to protect sensitive commercial assets, industrial facilities, and private critical infrastructure — especially as drone usage proliferates in civilian contexts.

Regionally, specific European countries — led by tech‑savvy and defense‑oriented nations — dominate the share. According to the MRFR segmentation, countries such as Germany, UK, France, along with others like Italy and Spain, are shaping market dynamics because of higher defense budgets, advanced R&D capabilities, and more urgent national security priorities.

In effect, demand is being pulled by a combination of strategic defense needs, homeland security concerns, and a rising awareness of drone‑based threats — conditions that collectively support sustained growth and broad adoption across user segments and geographies.

More Report:

italy remote weapon stations market

russia remote weapon stations market

uk remote weapon stations market